Oklahoma Auto Insurance Quotes

With regards to safeguarding yourself and your vehicle, understanding Oklahoma auto insurance quotes is fundamental. These quotes address the assessed cost of protecting your vehicle in light of a few variables remarkable to your circumstance. In Oklahoma, having auto insurance isn’t simply a suggestion yet a legitimate necessity. Contrasting quotes from different suppliers permits drivers to find the best inclusion choices at cutthroat rates, guaranteeing that they are sufficiently safeguarded out and about. By finding opportunity to investigate and comprehend these quotes, Oklahoma inhabitants can arrive at informed conclusions about their auto insurance approaches.

Factors Influencing Auto Insurance Quotes in Oklahoma

Auto insurance quotes in Oklahoma are impacted by different variables, including the driver’s age, driving history, and the kind of vehicle being protected. Youthful and unpracticed drivers frequently face higher expenses because of their apparent higher gamble, while a perfect driving record can fundamentally decrease insurance costs. Moreover, where the vehicle is principally left assumes a part, as metropolitan regions with higher gridlock and crime percentages will generally have higher insurance rates. Different contemplations incorporate the vehicle’s make, model, and year, as well as the driver’s picked inclusion cutoff points and deductibles.

Sorts of Inclusion to Consider

Oklahoma drivers have a few inclusion choices to look over while choosing an auto insurance strategy. Responsibility inclusion is required and takes care of the expense of harms and wounds to other people assuming that the policyholder is to blame in a mishap. Past the necessary risk inclusion, drivers can pick extra insurance, for example, crash inclusion, which pays for harms to their vehicle, and thorough inclusion, which covers non-impact related episodes like robbery or cataclysmic events. Uninsured and underinsured driver inclusion is likewise suggested, as it gives monetary security in situations where the to blame driver needs satisfactory insurance.

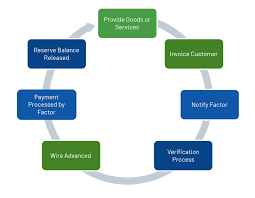

The Significance of Contrasting Quotes

Looking at auto insurance quotes is vital for Oklahoma drivers who need to track down the best harmony among inclusion and cost. Different insurance suppliers utilize fluctuating measures to decide premium rates, and that implies that a similar driver can get unfathomably various quotes from various organizations. By looking and getting quotes from different safety net providers, drivers can recognize the most reasonable choices that actually meet their inclusion needs. Online correlation instruments make this cycle simpler, permitting shoppers to view and think about rates from various suppliers rapidly.

Step by step instructions to Get Exact Quotes

To get exact auto insurance quotes in Oklahoma, drivers ought to be ready to give definite data about themselves and their vehicles. This incorporates individual data like age, orientation, and conjugal status, as well as insights regarding the vehicle’s make, model, and mileage. Giving a total and precise driving history is likewise fundamental, as insurance organizations utilize this data to evaluate risk. Moreover, drivers ought to indicate as far as possible and deductibles they normally like to guarantee that the quotes they get line up with their ideal degree of security.

Ways to bring down Auto Insurance Expenses

There are a few methodologies Oklahoma drivers can use to bring down their auto insurance costs. Keeping a perfect driving record is one of the best ways of keeping expenses low. Drivers can likewise consider expanding their deductibles, which can diminish premium expenses, albeit this implies they will pay more personal in case of a case. Packaging auto insurance with different sorts of insurance, like mortgage holders or tenants insurance, can likewise prompt huge limits. Moreover, numerous back up plans offer limits for security highlights, low mileage, and guarded driving courses.

Conclusion

Understanding and looking at Oklahoma auto insurance quotes is fundamental for tracking down the right inclusion at the best cost. By taking into account the different elements that impact quotes, investigating various sorts of inclusion, and using methodologies to bring down costs, drivers can settle on informed conclusions about their auto insurance approaches. Getting some margin to research and contrast choices guarantees consistence and lawful prerequisites as well as gives true serenity out and about. With the right methodology, Oklahoma drivers can get exhaustive security while remaining acceptable for them.